2017 Q4 Summary

Happy New Year to everyone!

2017 is easy to summarize. A robust first half was followed by a slow second half. High expectations for the year turned neutral, as volatility reached all-time lows, and trading dried up. Robust first half hiring turned into “hiring pauses” and then outright freezes.

CBOE Volatility Index

We hear that budgets for 2018 are flat, so hiring will be the usual churn of bodies, not new initiatives, and likely not as strong as the beginning of 2017.

Hedge funds continue to have a tough time in this environment, but results are highly idiosyncratic. We’ve seen a number of clients shut down, scale back, or reinvent themselves over the past couple of years. Per Hedge Fund Research, an estimated 222 funds closed in Q2, making it the seventh quarter in a row where funds closed than opened. However, there are other signals that the buy-side environment is improving overall.

What’s Hot

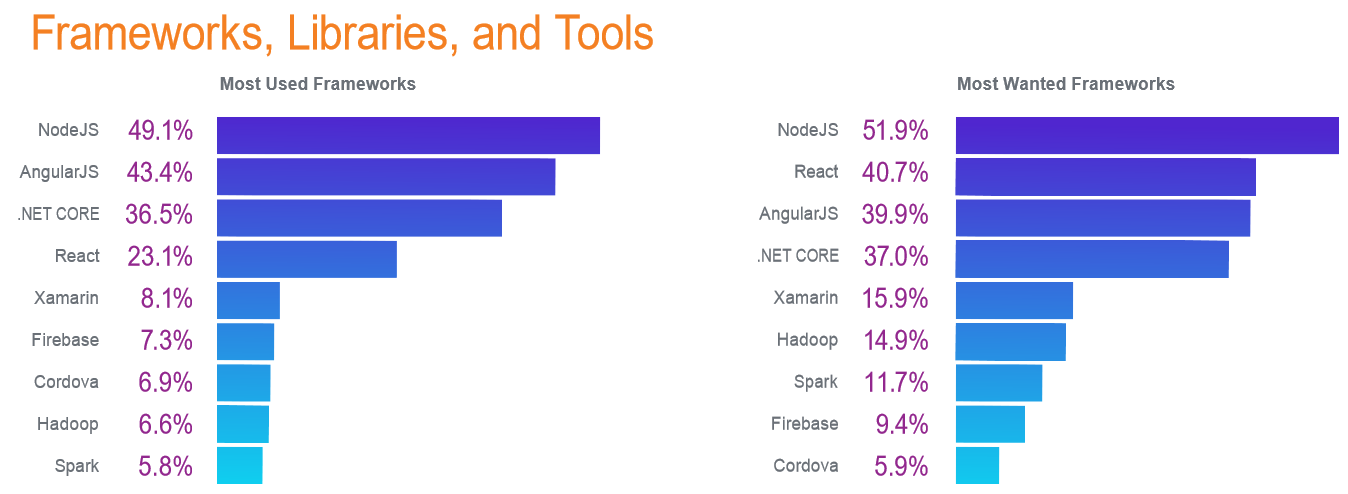

We saw a significant increase in demand for JavaScript (AngularJS and React) and Python this year. There’s nothing surprising about that given the overall technology trends highlighted in the following chart from Stack Overflow’s annual developer survey:

For our clients, the demand for JavaScript/web development experience stems from a rapid adoption of web technology for building front-ends. As for Python, the demand is driven by data processing, data analytics, natural language processing (NLP), and data visualization as well as an embrace of the language for its productivity versus other languages.

As always, our clients seek outstanding developers regardless of the language of choice. I had a hiring manager last week tell me that he doesn’t care if a candidate knows python and said he himself had never used it before starting at this current company.

Data Science

Big Data was the hot topic a few years ago, but now it is almost passé. Data Science is the latest rage, and we see graduates pouring off campus with their targets set on Data Science roles. I thought the below Venn Diagram was a clever and accurate visualization of the attributes of a Data Scientist and related roles.

While we are seeing high demand for data developers, specifically individuals who are adept at sourcing data (especially unstructured data) and implementing the entire data life cycle, we are not seeing a demand for Data Scientists. My take is that there is a good supply of candidates seeking those positions, hence our services aren’t needed in that area.

Resumes…

Here’s my favorite resume tidbit from the past couple of months:

Reminder – it’s worth the time to make your resume good. What does that mean? Easy, do some research, look at examples, ask me, and have someone proof your resume, especially if you are not a native English speaker. I see so many bad resumes, mostly from candidates who don’t put adequate effort into the task. A mediocre resume says something about you.

Compensation Benchmark

People are always interested in knowing, what do hedge funds pay? It’s an impossible question to answer as there are too many variables at play. However, I can provide a benchmark. This past year we’ve seen grads from top Comp Sci programs (BS) see offers in the neighborhood of $200k from leading hedge funds. This example is not to say that all recent graduates who go to work at hedge funds make this kind of money. On the contrary. This benchmark is for highly desirable graduates from leading programs that the top hedge funds are actively competing for.

Arguing with Your Manager

Lazlo Bock was head of People Operations at Google for 10 years. In his book, Work Rules, he discusses in depth how Google manages its people operation. He offers some excellent advice for how to manage your career. In the book, he talks about advocating for yourself and even arguing with your manager about your performance appraisal, though not to the point where you might piss your manager off: “And even if I don’t argue with my manager, he’s worried that I might.“ The point is, you need to be proactive about managing your career and keep an open dialogue with your manager regarding career advancement.

Predictions for 2018

Here is a thoughtful compendium of 50 predictions for 2018. Also 10 Fintech Predictions. Thanks to the Financial Revolutionist for their Weekly Briefing including these links and others.

The New Tax Law and “Velvet Layoffs”

This article predicts the FinTech landscape in 2028. One prediction talks about the “Gig Economy” being replaced by the “LLC Economy.” The recent tax legislation heavily favors pass-through entities, and we expect to see an increased number of professionals move to the corp-to-corp contracting model. The article even predicts the facilitation of this setup for key employees in the form of “velvet layoffs” allowing senior executives to realize the tax benefits of operating as a pass-through entity. Expect new regulations around pass-through entities for single employee companies.

Opportunities

Please follow AffinityFin to be apprised of new opportunities. Of course, the best way to learn about available opportunities is to email or call me directly.

Current Priorities

Buy Side

- Senior React Developer – client facing applications

- Senior C++/FIX Developer – market data, OMS Connectivity

- Senior Java Developer – real-time PnL

- Senior KDB Developer/Strat – Surveillance technology

- Senior Python Developer – to build research platform for new hedge fund arm of leading asset management firm – python experience not required

- C# Developer Contract – Risk attribution

- Java Developer Contract – Risk attribution

- Senior Hands-on Java Lead - Regulatory and Compliance technology

- Cloud Migration Specialist

- Elite C++/Python developers to help develop a new trading platform

- Expert C++ developers to help build multi-strategy trading infrastructure

- Post Trade Strat – C#/.Net developer for a top hedge fund focused on post-trade automation

Sell Side

- SPG Desk Quant – Leading investment bank

- Treasury Desk Quant – Leading investment bank

- Fixed Income Strats Developer – Crack development team embedded within the Strats team on the business side – Java/Scala/Python/KDB/JavaScript – language agnostic

- JavaScript/AngularJS – full-time and contract

- Scala developer – Contract, wealth management

- Java developer – Contract, wealth management