2025 Q1 Market Report

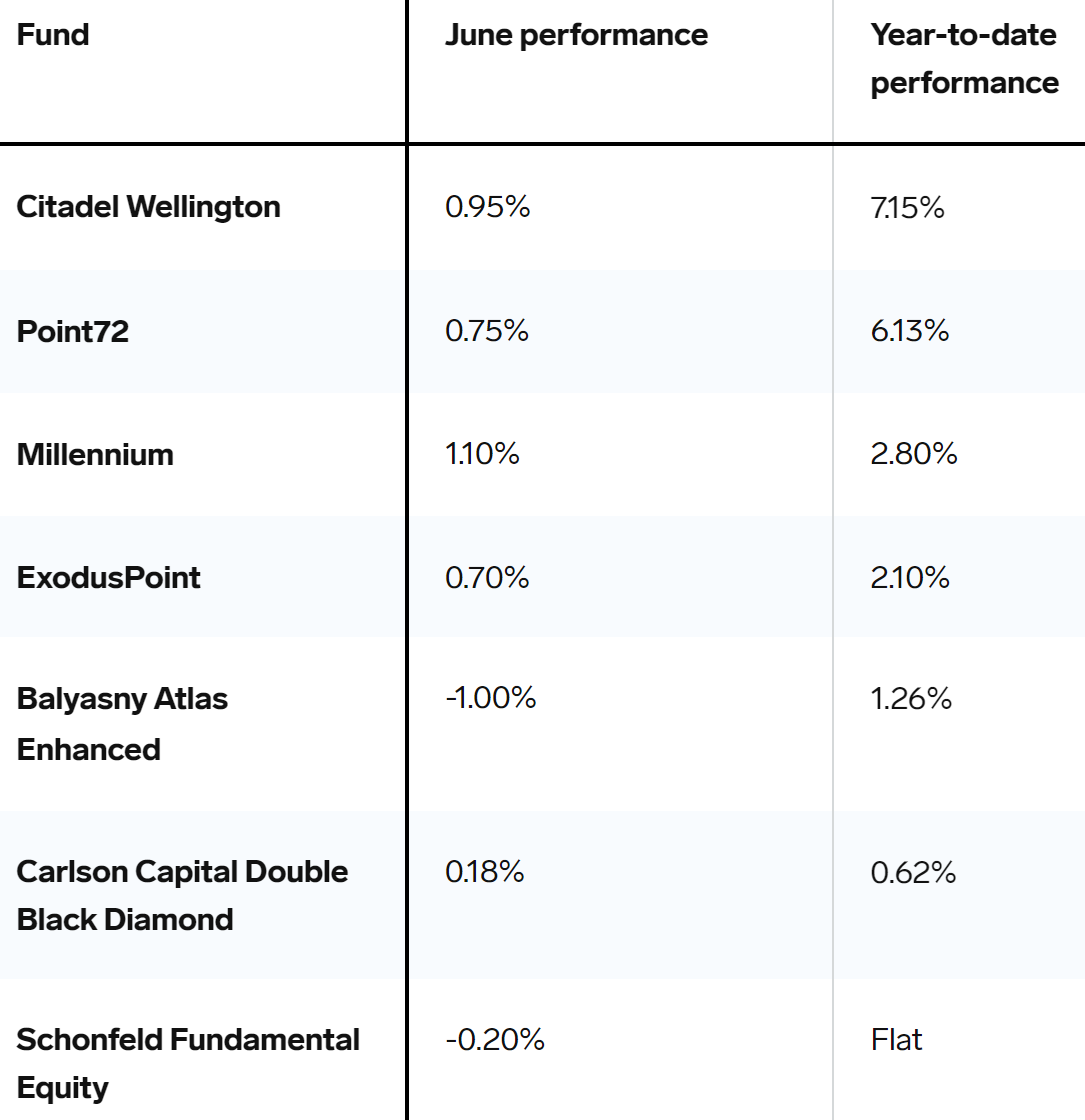

I write this as the market is in a freefall today. With the economic shit-show being directed by the White House, there’s no telling when the market will pick up in a meaningful way. I’ve just updated the graphic above for the 3rd 4th time, since the probability of recession (Polymarket) keeps moving up so rapidly. Many of our clients are funds that thrive on volatility, but even that’s not a given as Citadel and Millennium both lost money in March for the 2nd straight month.

None of this is fun to talk about, so let’s look at some interesting odds and ends.

Jevons Paradox

Developers, take note, AI will not replace you! Per Gartner, AI Will Not Replace Software Engineers (and May, in Fact, Require More).

In the short term, AI will operate within boundaries. AI tools will generate modest productivity increases by augmenting existing developer work patterns and tasks. The productivity benefits of AI will be most significant for senior developers in organizations with mature engineering practices.

In the medium term, the emergence of AI agents will push boundaries. AI agents will not replace human developers but will transform work patterns by enabling developers to fully automate and offload more tasks. This will lead to the rise of AI-native software engineering.

In the long term, advances in AI will break boundaries.

However, the role of the SE will evolve substantially. Philip Walsh (also Gartner), wrote Redefining the Software Engineer's Role in the Age of AI:

As AI matures, it will drive demand for a new class of software engineering skills. This shift marks the beginning of AI-native software engineering, a field that will require developers to operate with an AI-first mindset, focusing on guiding AI agents through complex problems rather than solving them independently. AI-native engineering will depend heavily on prompt engineering, natural language processing and retrieval-augmented generation (RAG) skills.

This evolution aligns with a phenomenon known as the Jevons Paradox: as AI makes software engineering more efficient, it will increase demand for software engineers rather than reduce it. AI’s capabilities will unlock new avenues for innovation, requiring more human talent to lead AI-centric projects, with skilled developers playing a pivotal role in the creation of AI-driven applications, demanding a blend of traditional software engineering knowledge and AI-related skills.

So, start working on your prompt engineering.

Current Demand

That said, our clients continue to hire hardcore coders, and I don’t see that changing anytime soon. I can guarantee you that we’ve yet to see a job spec that emphasizes high level skills in prompt engineering. Yes, we are now seeing more and more requirements for experts in GenAI, but these efforts are not replacing the engineering staff (not that there aren't some knock-on effects). And as the section below emphasizes, the required skills for engineering roles at top hedge funds remain unchanged.

We have a new challenge in finding good engineers. Just about every newly minted Comp Sci grad has concentrated in ML/AI and is targeting roles directly involved in AI – for good reason. It’s actually getting harder and harder to find good jr-mid software engineers to work on non-AI related work! So while you may want to work on ML/AI related projects, you may find that targeting non-ML/AI roles is more fruitful.

Communication

Ken Griffin recently returned to his high school in Boca Raton last week to speak to students. As for what he looks for in applicants, he said, "Number one, we look for intellect, aptitude, and communication skills." On communication, he said, “When I started my career, the person who was my primary provider of capital had a plaque in his office that said, 'If we're all going to eat, someone has to sell.'"

He also mentioned grit, perseverance, and determination.

You’ll note that none of these necessary attributes will change in the face of AI.

F*ck Leetcode

Interview Coder, not linked here on purpose (we strongly advise candidates to never cheat in any way), is making a splash with a tool for cheating on coding interviews. The tool is an AI assistant that hides itself from popular code testing platforms like CoderPad. You may disagree with Leetcode style interviews, but everyone knows companies use them widely, so there’s no excuse not to be ready for these types of questions. You can be sure that firms will quickly find a way to combat this tool. And if you get caught using it – game over. Speaking of which, I just found this post on Reddit:

I kept seeing the Interview coder founder going viral on Twitter for how his app is completely undetectable. Stupidly, I trusted what I read on the internet and tried using it in an actual interview on CoderPad with LinkedIn today. As soon as I tried using it, the interviewer goes "Buddy, are you serious right now?" The interviewer definitely knew I was using Interview coder and ended the interview almost immediately after that. I am SOOO pissed right now because I think I could have come up with a decent enough solution to the problem without cheating and now I am definitely blacklisted at LinkedIn and probably at Microsoft too by proxy.

No Tech Screens!

Contrast above with government hiring practices outlined in this Odd Lots podcast Why Government Hiring Is So Inefficient | Odd Lots. Due to discrimination concerns, hiring managers cannot ask candidates technical questions. HR evaluates candidates, and the tech “screening” consists of selecting those candidates who have rated themselves highly in a self-rating of the various required competencies. That’s a little different! I know someone works for a government agency. From talking to him, it sounds like the signal in their interview process is no less effective than what our clients use :).

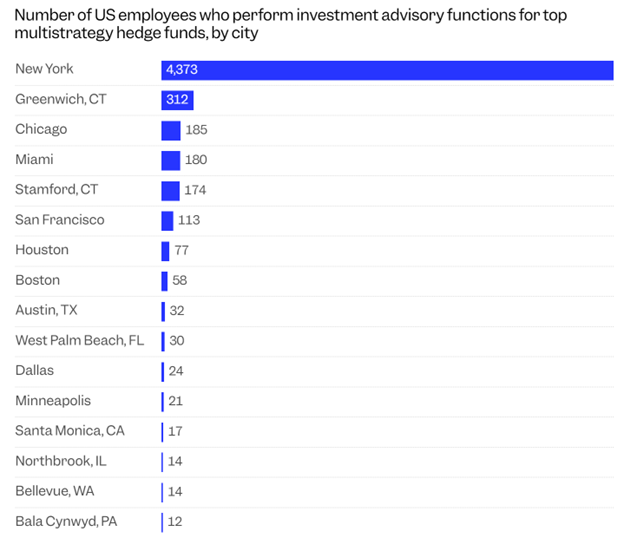

It's Still New York

While a lot was made of firms moving south from New York in recent years, especially Citadel’s move to Miami, New York remains firmly the epicenter of the financial universe, almost laughingly so:

New Market for Compute

In January, Compute.Exchange was launched to create a market in what is expected to soon be the world’s largest commodity – Compute. Per businesswire:

“Compute Exchange today announced the world’s first open exchange for GPUs and other forms of compute resources, addressing the needs of both buyers and sellers in the dynamic and rapidly growing AI compute market. The platform ensures mutual benefits for both parties by fostering fairness with real-time price discovery, standardized contracts, and flexible purchasing. Through an auction-based system, the exchange connects buyers and sellers on equal terms, creating a transparent environment for compute trading designed to drive innovation and broaden access to critical AI infrastructure.”

Compute.Exchange was founded by Simeon Bochev (CEO) and Don Wilson (of DRW). I just love this idea. I suppose it was inevitable?

Current Priorities

SE: Software Engineer

QD: Quantitative Developer

QR: Quantitative Researcher

HF: Hedge Fund

FinTech

Founding Engineer - Low-latency, low-level SE – New L1 Blockchain

This is a very special opportunity to be a significant part of a potential seismic shift of the crypto/blockchain universe. Yes, that sounds hyperbolic! - but this is one of the highest leverage opportunities you’ll find. Please contact me for additional information.

Support - Client & Trading Success Analyst - Remote

QR - Credit Quant - Macro and PT - Remote

SE - Software Engineer (Distributed Systems) – Scala/Functional - Remote

SE - Staff Software Engineer (Distributed Systems) – Scala/Functional - Remote

SE - Staff Software Engineer (Trading Automation) – Scala/Functional - Remote

SE - UI Developer – Typescript/React - Remote

DevOps - Senior Platform Support Engineer - Remote

Tech Ops - Technology Operations Manager – Remote

Buy Side

Most in Demand: C++, GenAI, Data/ML Engineering, Lead Engineers

Notable: Quite a few Lead engineering roles, return of C# SE roles (new client)

Lead SE - Applied GenAI Lead Engineer - Python

Lead SE - C# - Macro Technology

Lead SE - GenAI Adoption/Integration - Python

Lead SE - Java - Post Trade Technology

Lead SE - Java - Treasury Technology

Lead SE - UI - Javascript/React - Macro Technology

Lead SE/QD - Python - Treasury Technology

QD - C++ - Global Macro

QD - C++ - low-latency

QD - Flow of Funds

QD - Global Macro

QD - Python - Miami

QD - Research Production-ization - San Fran

QR - Alpa - Macro Trading

QR - Credit - Macro and PT

QR - low-latency - Equities/Futures

QR - Macro Signals

SE - Applied GenAI Engineer - Python

SE - C# - Converts Front Office

SE - C# - Data Engineering

SE - C# - Macro Front Office Technology

SE - C# - Macro Middle Office Technology

SE - C# - Macro Trading

SE - C# UI - San Fran

SE - C#, React, OTC Deriv, OMS/EMS - Macro Execution

SE - C++ - Central Research

SE - C++ - Electronic Trading

SE - C++ - Execution

SE - C++ - low-latency

SE - C++ - low-latency

SE - Desk SE - Python

SE - GenAI Adoption/Integration - Python

SE - Javascript/React - San Fran

SE - UI - Javascript/React - Macro Technology

SE - UI - Javascript/React - Macro Technology

SE/QD - Python - Treasury Technology

SRE - Macro Technology

DevOps - Trading Operations Engineer

Sell Side

Nothing – nothing!