2022 Q3 Market Report

The market right now is – not good. You don’t need me to tell you that. The overheated market from a year ago is gone and has taken with it the inflated salaries that became commonplace. There are still high-paying jobs, but competition is fierce and standards high for those firms still hiring at those levels.

So why are we so busy? Hedge funds, hedge funds, hedge funds! As recently as 2 years ago I referenced 9 straight quarters of hedge fund outflows, but since that time the trend has reversed. Hedge funds have performed well during the market downturn. From Hedge funds strike back after a lost decade:

“Hedge funds in today’s bear market have significantly outperformed equities, with average returns of -5.6 per cent between January and June 2022 compared to broader equity market declines of – 20.5 per cent on the MSCI World Index.”

The article also outlines broader macro trends in the industry including higher fee structures (DE Shaw) and a tight talent pipeline. Regarding that talent pipeline, we have a front row watching the Tech industry drain a huge amount of talent from hedge funds, both people leaving finance for Tech as well as grads choosing Tech over Finance to start their careers. Now in growth mode, the Funds are upping salaries and luring top people back.

Why Did Salaries Go Bananas?

Salaries in our industry increased so much over the past 2 years that I wanted to explore how this phenomenon came to pass. The surge in post-Covid tech hiring coupled with a combination of market factors appear to be the perfect storm that fueled the sharp rise in salaries.

Below chart shows the steep increase in salaries since 2020. We see the sharp “hockey-stick” shape that is A) unusual and B) unsustainable. So, what happened?

Demand for top software engineers has outstripped supply for decades. But post Covid, there was an enormous amount of fuel to trigger the spike in salaries:

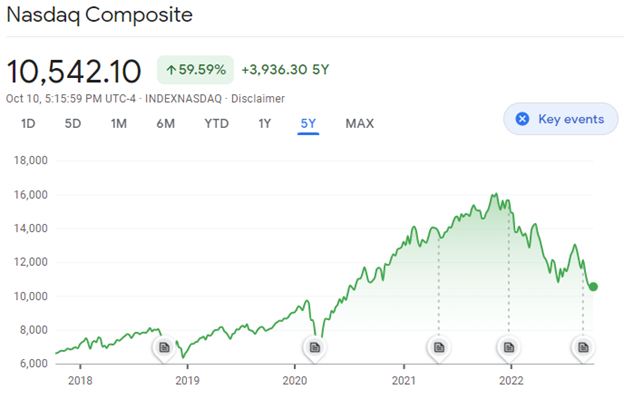

Rising Stock Market

Increased VC Funding

Record Bank Earnings

Hedge Fund Rebound

Stock Market Boom – Inflated stock prices provided FAANG and other tech firms the resources to offer ever larger, stock dominated packages. In addition, people working at these companies saw significant growth in the value of the shares that they had accumulated making them feel like they were earning even more and making them “sticky” with these firms, i.e., harder to recruit and more expensive to outside firms. I had a number of conversations with individuals in their mid-20’s telling me that if I had anything that was 7 figures, we could talk. Those conversations have changed.

Increase in VC Funding – A large uptick in venture funding providing the money needed for startups to compete with Big Tech for talent, even as Big Tech was paying every larger salaries.

Record Bank Earnings – banks losing tech talent to Big Tech had great earnings allowing them to be more competitive.

US Hedge Funds Assets Increased – Systematic and Market Making hedge funds depend on great engineers and quants for their market advantage. These firms are best positioned to pay the most for top talent, and their assets have been increasing (US – globally negative).

The result has been unprecedented salary growth for developers and quants. I wish I could give a real figure for the average growth in compensation over the past 2 years, but it’s very hard with the data I have. Offhand I estimate that salaries for top performers increased 30-50% over just the past 2 years. But there’s a reason your base salary is ~$200k when you earn, say, $600k total per year. Compensation structures allow firms to adjust salaries down when the market warrants it. The toppy money of the past couple of years is has come off the table, and we should expect the hockey stick in the first diagram to look more linear over time.

Google -> Goldman

The flow of tech talent from finance to tech doesn’t just go one way. Interesting hire. Goldman continues to innovate.

So You Want a Citadel Internship?

It’s hard. Really hard: “Citadel had 33,000 applicants and accepted only 290.” Citadel is a tough place to work, unapologetically, but they have no trouble attracting applicants. And it seems to work.

Career Growth

Most people I talk to stress opportunity for growth as a priority when evaluating a career move. I always ask, what does “growth” mean to you? It’s not uncommon that people don’t really know, they just know that they should be seeking it. This slide presentation by Nikolay Stoitsev is a good discussion of Individual Contributor vs Engineering Manager Career Ladders, choosing the path that’s right for you, and how to grow at each level. I doubt that most people are as directed and premeditated about career progression as Nikolay, but it’s good food for thought and contains a lot of practical ideas.

Defi?

I watch Defi because it’s becoming a larger and larger part of the overall financial market, draws a lot of talent, and I find it fascinating

The Merge happened successfully. “The network’s climate pollution drops from roughly 11 million tons of CO2 emissions a year to around 870 tons, which CCRI says is slightly less than the amount of energy 100 homes in the US would use in a year.” A huge win! But now: “The Ethereum blockchain has become more centralized following the shift to proof-of-stake as 60% of validators are managed by only four companies.” That seems not great.

Did you see: Most Likely This Person Is Satoshi Nakamoto.

Affinity North Team

Not everyone knows the great Affinity North team. Please see their bios linked below:

Welcome Neil Brookes! Neil is a former equity derivatives trader who rounds out our crew with extensive knowledge of markets.

Current Priorities

FinTech

Most in Demand: Distributed Systems/Micro Services, Cloud, Data Engineering

BlockChain Application Developer – language agnostic, prior BlockChain experience not required

BlockChain Platform Developer – language agnostic, prior BlockChain experience not required

Mid-Senior Scala Developer

Lead Developer – Consumer Risk – Credit/Fraud experience required

Senior Developer – Payments systems – language agnostic

Senior C# Developer

Buy Side

Most in Demand: C++, Python, Data Engineering, Cloud, SRE, Trading Systems Support

Mid-Senior C++ Developer – Execution team

Full-stack developer – Python/Java/Javascript

Senior Options Analyst – Options Post-Trade SME – Operations

SRE – Data platforms

Trading Systems Support Lead

Tech Writer – data science

HFT QuantDev – C++/Python

Senior Low-latency C++ Developer – OMS

Senior QuantDev – C++ - Options, Equities

QuantDev – centralized research platform

Senior QuantDev – centralized research platform

HF Algo C++ Developer

Quant Researcher – equity alpha research

C++ QuantDev – Equity Execution/Market Microstructure

Senior C++ Developer – low-latency - small, captive HF

Data Engineer – Python

Junior (0-2+ years) - QuantDev – Python

C++ low-latency QuantDev

Cloud Engineer – AWS/GCP

Quant Researcher- financial/alt data, trading signals/models

Ultra-low-latency C++ Developer

Senior Java Developer – post-trade

Full-stack Data Engineer

Data Engineer/Senior Data Engineer – NYC/Miami

C++ Engineer/Senior C++ Engineer – NYC/Miami

Senior Software Engineer – Post-Trade - Fixed Income experience required – NYC/Miami

Low-latency C++ Developer – market making

Quantitative Developer – Core components

Front-end Tooling Engineer

C++ Developer – Digital Assets

Cloud Architect – Public Cloud Enablement

Software Engineer – Public Cloud

Systems Support Engineer (SSE)

Reliability Engineer (SRE)

Tech Lead Cloud Data platform

Junior Python QD – small Prop firm – “many hats”

Java Developer – Structured Products - Intex

Sell Side

Most in Demand: C++, Java, Data Engineering, Big Data, Cloud

C# WPF Developer

Java Developer – FX Pricing

C++ Developer – OMS/market data – options trading

C++ Developer – OMS/cross asset

Scala Developer – Credit eTrading Strats

Data and Knowledge Engineer – Semantic and Graph technology

Senior UI Dev/Architect – Semantic and Graph technology

Global Lead - Sustainability Engineering and ESG Data Analytics

Lead Java Developer – Investment Management