2023 Q2 Market Report

In a word, bad. The current market is bad. Computers still need to be programmed, and AI won’t do it yet, so there are always jobs for good developers. However, we’re in a very tough job market right now, and it likely won’t improve until 2024. Take a look at a snapshot of Investment Bank hiring over the past 3+ years:

This picture doesn’t tell the full story. As far as I know, every investment bank is currently frozen on hiring. Yes, there are still job postings on citi.com, jpmc.com, etc., but the current openings are mostly in areas like corporate IT rather than front-office systems. I don’t expect these freezes to end before 2024 as firms are already looking ahead to 2024 budgets, and the same economic uncertainties that drove the first half of this year persist making a turnaround very unlikely this year. Q2 earnings aren’t good.

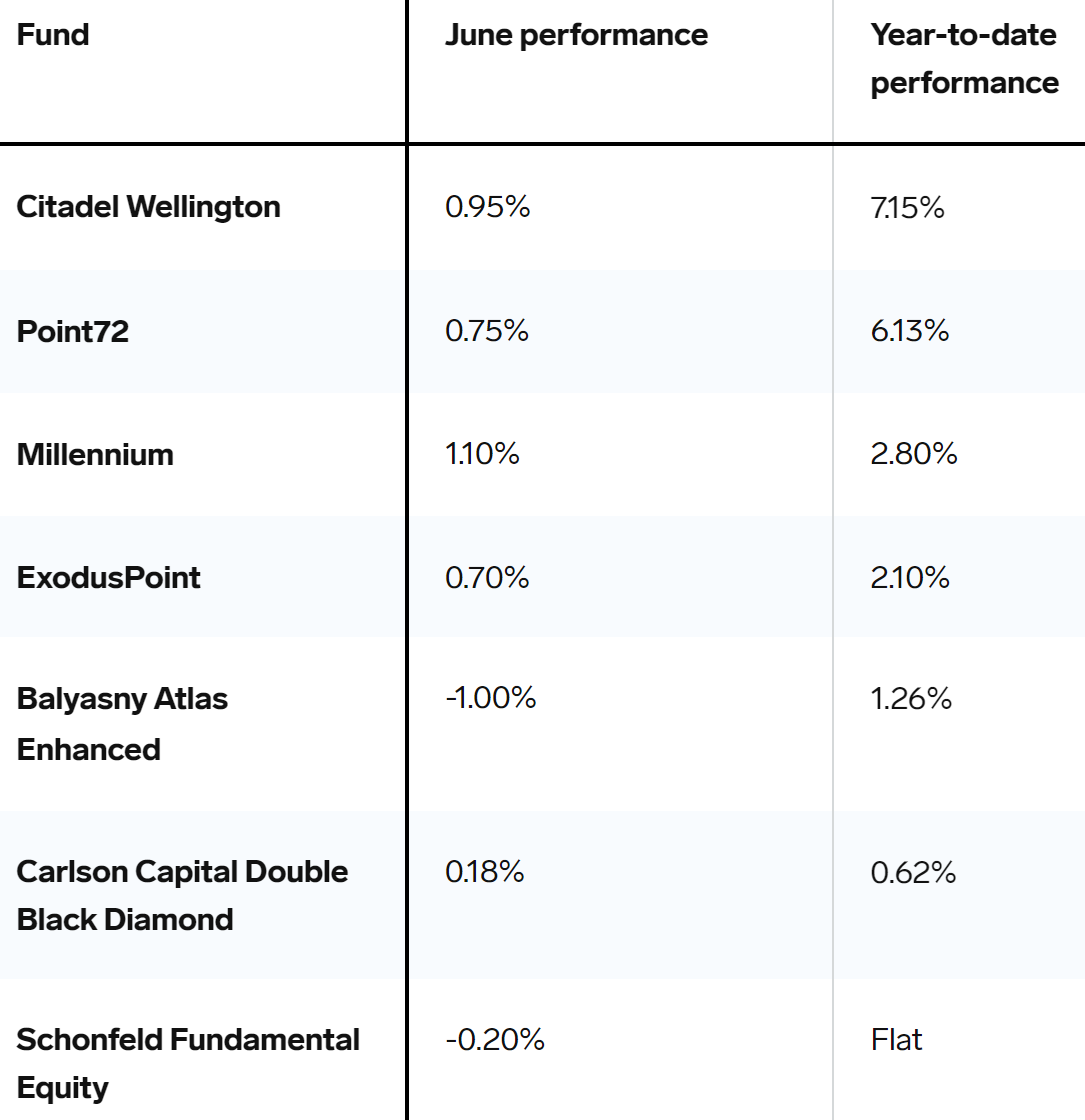

As highlighted in the last report, hedge funds have been a bright spot this year, continuing to hire in support of ever more complex trading strategies. However, hiring is slowing now, as positions are steadily filled. Of course, there is much more performance variability among hedge funds, so hiring is more variable too. One large HF client abruptly put all tech hiring on hold a few weeks ago and laid off the technology recruitment team due to a poor year. We haven’t seen anything as dramatic at other firms, but it’s certainly not a good sign.

Fintech is a mix, less dictated by the macroeconomic picture. We have several fintech clients that are actively hiring.

This market has been toughest on mid to senior management. That’s not unusual, but it’s been a while since I’ve seen so many outstanding people unable to find their next opportunity. Over the past decade, Big Tech took up much of the slack when financial firms were downsizing, and clearly those firms are not a fallback right now. Other sectors remain an option, and in fact, US tech jobs showed a net 45,000 gain in May 2023.

Despite this grim news, there are some very good jobs out there. Our Current Opportunities section is brief this quarter, but contains some truly outstanding roles.

Back to Office II

The arc of companies adopting remote/hybrid and now returning to office feels like it is hitting equilibrium. Big companies want their employees back in the office, at least 3 days/week if not more. There’s far less threat from tech companies offering significantly more flexibility to their employees. For example, Robinhood went fully remote and then less than a year later announced RTO 4 days/week. That said, there are still companies offering remote work, but with less competition, expect a lower salary in return. LinkedIn published some interesting statistics on this topic.

A friend of mine recently described the scene at JPMC – people in the office, at their hotel desks, headphones on, typing away…

Big Pay for Some

As mentioned last quarter, top people continue to get paid despite the down market. While our practice doesn’t see “Tom Brady like pay packages,” the $ do trickle down to the SE/QD/QR’s supporting these PMs.

Some Advice If You Are Looking

If you’ve worked in the industry for some time and have significant industry/institutional knowledge, that next job at another IB just isn’t there right now. Look at firms that support the financial industry – consultancies, vendors, etc. These firms will value your institutional knowledge. Companies like Snowflake are building significant verticals in financial services.

Cast a wide net.

Leverage your network – your resume will be lost in a company job portal.

Lower your expectations– your next job may be temporary until things improve. Nobody recommends job hopping, but loyalty works two ways - your next employer needs to justify your staying when more opportunities are available.

Current Priorities

SE: Software Engineer

QD: Quantitative Developer

QR: Quantitative Researcher

HF: Hedge Fund

Buy Side

Most in Demand: Fewer roles currently, hard to generalize

Trade Support – Ops – Small HF (great opportunity if you work in trading ops)

C++ SE – Trading Systems

C++ SE – high frequency/low latency

Java/KDB/Python Engineer – uber dev for strategic technology group

Senior Java Engineer – ultra-low-latency trading systems

Senior C++ Engineer – ultra-low-latency trading systems

Python SE

Python/C++ QD

Algo C++ QD

Desk engineer – Typescript/React/Node.js (not UI) – San Francisco (super interesting!)

QR Lead – prop trading

C++ QD – prop trading

C# full-stack SE – prop trading

Senior Java SE – Trade Flow – London/Miami

Senior Python SE – Commodities – Miami

Junior QD – Python

Junior QD – Python/C++

C++ SE – Execution systems

Sell Side

Most in Demand: Nothing

FinTech

Jr-Mid Python Data Engineer

Senior Scala Engineer – Fixed Income, eTrading, Scala - Remote

SRE Team Lead – Remote

Lead Fixed Income eTrading Protocols Engineer - Fixed Income, eTrading - Remote

Senior/Lead Platform Engineer – Scala, eTrading, Fixed Income - Remote