2023 Q3 Market Report

We’ve been treading water for the past few months, as the macro factors that affect hiring haven’t changed significantly. Firms continue to operate cautiously as they have been for most of this year.

Banks – hiring is frozen as it has been for the entire year. I hear anecdotal stories of people interviewing at Barclays, BNY, and JPM, but the number of posted positions is at a level not seen since right after the pandemic started.

Hedge funds/Prop - a mix, but current demand is light. Though larger firms continue to build out critical infrastructure for ever more complex strategies/infrastructure, recruiting efforts over the past year have been successful, and many seats have been filled. Competition from Big Tech has been almost non-existent, and the flow has reversed in some cases with quite a few folks moving from Big Tech to Finance.

Fintech – demand is low here too, as money is much tighter. Recruitment for many firms has been taken in-house (sensible given supply of tech talent & recruiters!), so, we don’t see the full picture.

I expect 2024 to be better as banks likely will open up some hiring, hedge funds are likely to grow, and everyone needs technology for everything.

What’s the life preserver in the graphic? I don’t know, but I like the graphic.

Defi/Crypto

Crypto has cooled significantly since a couple of years ago when firms like Coinbase were scooping up talent at much inflated prices.

I love this article, What If: The Blockchain Economy, by Cloudwall founder, Kyle Downey. This piece significantly enhanced my understanding of the DeFi big picture.

Also, The Real Maxime podcast by Maxime Seguineau is worth following. Maxime interviews business and technology leaders who are shaping the industry. There’s an interview with Kyle Downey and don’t miss the episode with Mrinal Manohar: “5-9% of transaction cost is economic rent incurred in proving that something hasn’t been tampered with.” Hence, Blockchain, cheaper, inevitable.

Though the hype has diminished, there’s a ton going on in this segment, which is growing massively. DeFi remains a good career bet.

Current Remote/Hybrid Statistics

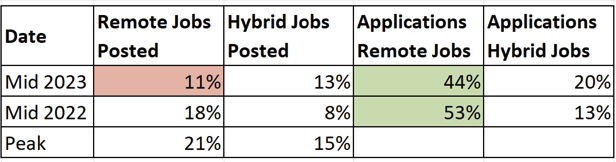

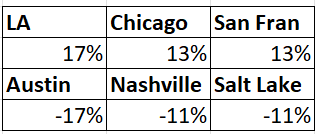

LinkedIn provides some interesting statistics regarding remote/hybrid job postings/applications. We certainly see these trends:

Remote and hybrid job postings have now decreased for the fifth straight month

Pandemic migration trends are reversing as migration to big cities speed up while migration to secondary cities slow down. Note these are trends - all of these cities are growing.

Communication!

We stress coding skills, problem solving, and mathematical aptitude when it comes to interview preparation. It’s obvious, but equally important at the top firms is communication:

"One thing that always matters to us at Citadel is communication skills," said Griffin. "Our colleagues are almost universally good communicators. We copied that from Goldman Sachs. If you look back 15 years, the people at Goldman Sachs were always more poised and articulate, and better able to express concepts.”

Miami

The hedge fund migration to Florida continues. Here’s a complete list of the firms that have opened offices in Miami. Millennium has rolled out a particularly interesting training program to help attract talent in South Florida.

Buy Side Inside Scoop

Great QuantNet thread here - A senior Buy Side QR has volunteered to answer questions on the QR career track – fields of study, interview process, prep, attributes firms look for, etc. Open ended forum.

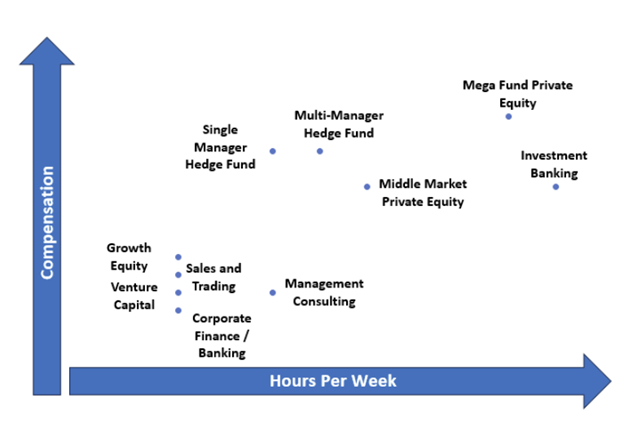

More inside perspective on Buy Side careers here from Buyside Hustle, as well as discussion of Work Life Balance by firm type/roles, see chart below. Note these are business side roles, but I think we're all interested?

Current Priorities

SE: Software Engineer

QD: Quantitative Developer

QR: Quantitative Researcher

HF: Hedge Fund

Buy Side

Most in Demand: C++, Python, QD, Prior industry experience, especially Buy-side experience

· Systematic Trader – track record required

· Lead Python SE – Miami

· Senior/Lead low latency C++ Developer - prop trading experience required

· Trade Support Engineer

· SRE/DevOps

· Research Technology Support Lead

· AWS Engineering and Support

· Java or Python SE – strategic technology group

· Java SE – authentication/entitlements

· Lead Data Platform SE – Python

· Python/C++ QD Equity Models Engineer

· Python QD – Equity Hedging

· QD portfolio optimization and backtesting

· C++ SE – Trading Systems

· C++ SE – high frequency/low latency

· Junior C++ SE – low latency

· Senior C++ Engineer – ultra-low-latency trading systems

· Python SE

· Python/C++ QD

· Algo C++ QD

· Trading Desk data engineer – Typescript/React/Node.js (not UI) – San Francisco

Sell Side

Most in Demand: Nothing

FinTech

· Lead Fixed Income eTrading Protocols Engineer - Fixed Income, eTrading - Remote